The Ultimate Guide To Frost Pllc

Table of ContentsAll about Frost PllcFrost Pllc Can Be Fun For AnyoneSome Known Details About Frost Pllc Some Known Facts About Frost Pllc.The Ultimate Guide To Frost Pllc

A bookkeeping job takes lengthy years in education and learning at least a four-year Bachelor's level, usually complied with by a fifth year or a Master's level.

As an example, some may like the idea of running their very own business but not the stress that comes with it. If you are truly enthusiastic regarding accountancy, a lot of these cons will certainly become pros! Choosing a profession as an accountant can be a solid choice provided the essential role accounting professionals play in preserving monetary records and preparing economic declarations, all based on generally approved accountancy principles.

Frost Pllc Fundamentals Explained

Bureau of Labor Stats, in their Occupational Expectation Handbook, suggests a solid job overview for accountants. The mean wage is competitive, and the demand for these specialists tends to stay stable, even in times of financial unpredictability. Accountants work across a variety of industries and industries, consisting of exclusive companies, federal government firms, and public accounting firms.

Accounting professionals require solid communication skills, attention to detail, and analytic abilities. Work candidates taking into consideration accounting settings must prepare for a profession path that requires precision, logical thinking, and a high degree of duty. Accountancy is both a difficult and rewarding area. Assisting clients file returns, manage financial data, and taking control of other accounting related-tasks can be stressful.

The ordinary accounting professional's average wage has to do with $75,000. The highest-paid 25 percent of workers make much even more than this, and there is the possibility to make six numbers as an accounting professional. Naturally, this relies on the accounting firm you function for, your education, and if you have a certified public accountant accreditation.

The Best Strategy To Use For Frost Pllc

Running a business commonly needs handling lots of responsibilities, and the economic elements can be especially complicated. This is where a professional service accounting professional can make all the difference.

Is having the same accounting professional for bookkeeping and taxes the most effective selection? Tax declare companies entails complex guidelines and requirements (Frost navigate here PLLC). The consequences of unreliable filings can be extreme, varying from missed possibilities for tax financial savings to prospective lawful issues and audits. Right here's why obtaining your tax obligations right the very first time is vital: A specialist accountant possesses a thorough understanding of tax obligation laws and guidelines.

Having an expert accountant managing your tax prep work considerably reduces the risk of such concerns. Consider this circumstance: An organization proprietor tries to manage their taxes independently, inadvertently leaving out a substantial source of income.

Frost Pllc Fundamentals Explained

A professional accountant is well-versed in existing tax obligation legislations and laws, ensuring your business is fully compliant. Currently that we've talked about the benefits of having an accountant for bookkeeping and filing taxes, let's explore why it's advantageous to make use of the very same professional for both bookkeeping and tax obligation requirements: Inconsistencies in between your books and tax returns can verify expensive.

Nevertheless, if discrepancies go unnoticed, you'll lose out on deductions, resulting in greater tax obligation settlements money out of your pocket. With a solitary accounting professional dealing with both obligations, your tax returns can be prepared much more effectively using guides they preserve. You avoid the inconvenience of guaranteeing that multiple accounting professionals have matching economic data, and your tax obligations are finished faster.

For several companies, the fostering of remote work stands for a new normal. This change has considerable effects on the means job happens, affecting every little thing from the innovations that organizations make use of to employee settlement models. This makeover has been specifically profound in the specialist solutions industry, where the procedures by which experts and accountants companion with their clients have changed dramatically.

Some Ideas on Frost Pllc You Should Know

Performing some aspects of an accountancy involvement from another location has actually come to be significantly preferred. It's not all smooth sailing, and there are some drawbacks to be aware of.

Because couple of companies concentrate on nonprofits, it's uncommon to find the most effective certified accounting professionals for any type of given interaction nearby. Partnering from another location with a seasoned not-for-profit audit company provides you accessibility to the most effective accounting professionals, anywhere they occur to be located. There are many benefits to functioning from another location with an audit company.

Tony Danza Then & Now!

Tony Danza Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Danica McKellar Then & Now!

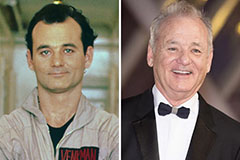

Danica McKellar Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!